Personal Loans copyright for Dummies

Wiki Article

Unknown Facts About Personal Loans copyright

Table of Contents3 Simple Techniques For Personal Loans copyrightThe Only Guide for Personal Loans copyrightWhat Does Personal Loans copyright Mean?Personal Loans copyright Fundamentals ExplainedRumored Buzz on Personal Loans copyright

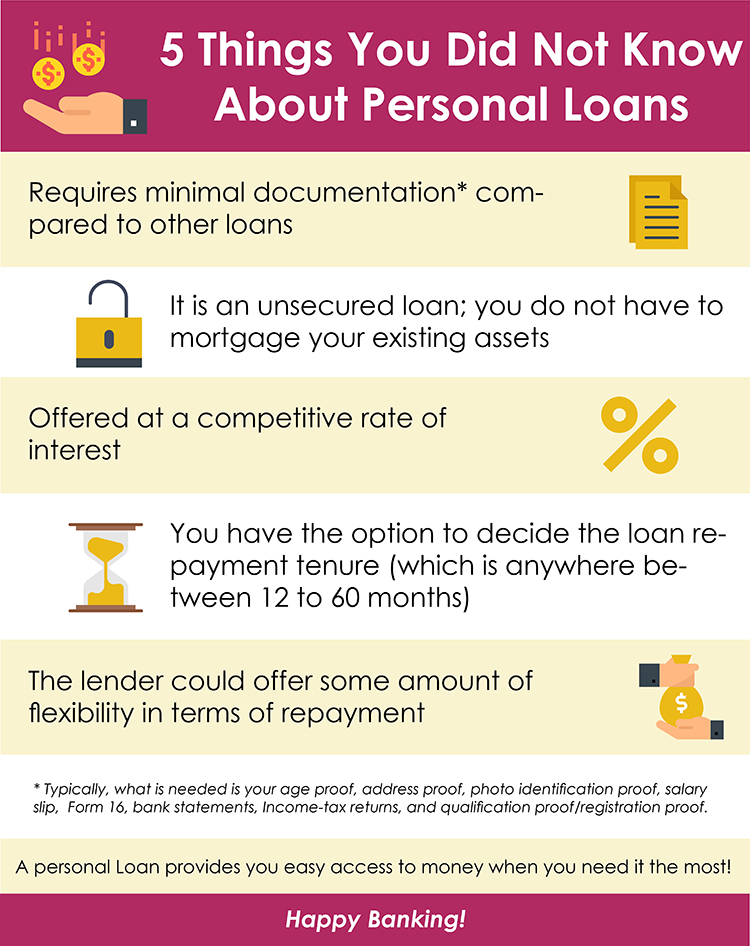

For some lenders, you can examine your qualification for a personal finance by means of a pre-qualification process, which will certainly show you what you might qualify for without denting your credit rating. To guarantee you never ever miss a finance repayment, take into consideration setting up autopay if your lending institution provides it. Sometimes, you may also get a rate of interest price cut for doing so.This consists of:: You'll require to verify you have a task with a consistent revenue so that you can pay back a car loan., and other details.

Indicators on Personal Loans copyright You Need To Know

, which is used to cover the expense of refining your loan. Some loan providers will certainly let you pre-qualify for a funding prior to submitting an actual application.This is not a tough credit pull, and your credit report and background aren't influenced. A pre-qualification can assist you weed out lenders that will not provide you a funding, but not all lending institutions supply this alternative. You can compare as several lending institutions as you would certainly such as through pre-qualification, by doing this you only need to finish an actual application with the lender that's most likely mosting likely to accept you for an individual lending.

The greater your credit rating, the more probable you are to receive the most affordable rates of interest supplied. The reduced your rating, the tougher it'll be for you to get approved for a finance, and even if you do, you might wind up with a rate of interest on the greater end of what's used.

Our Personal Loans copyright PDFs

Autopay lets you set it and neglect it so you never ever have to stress about missing a financing payment.The customer does not need to report the quantity obtained on the lending when filing taxes. Nevertheless, if the financing is forgiven, it is considered a canceled financial obligation and can be tired. Investopedia appointed a national study of 962 united state grownups in between Aug. 14, 2023, to Sept. 15, 2023, that had actually obtained a personal loan to learn how they utilized their funding earnings and exactly how they might use future personal financings.

Both personal lendings and charge card are two options to obtain cash up front, but they have various objectives. Consider what you need the money for prior to you select your payment option. There's no incorrect choice, but one might be a lot a lot more expensive than the various other, depending upon your needs.

Yet they aren't for everyone. If you don't have excellent credit rating, you could require to obtain the assistance of a co-signer who accepts your funding terms alongside you, tackling the legal responsibility to pay down the financial obligation if you're incapable to. If you don't have a co-signer, you could qualify for an individual car loan with negative or fair credit, however you might not have as numerous alternatives compared to somebody with excellent or outstanding credit scores.

A Biased View of Personal Loans copyright

A credit report of 760 and up (outstanding) is a lot more likely to get you the most affordable interest price available for your financing. Consumers with credit report of 560 or below are much more likely to have difficulty receiving far better loan terms. That's because with a lower credit rating score, the rate of interest has a tendency to be expensive to make an individual financing a sensible loaning option.Some factors lug even more dig this weight than others. 35% of a FICO score (the kind used by 90% of the lenders in the nation) is based on your repayment background. Lenders wish to make certain you can take care of financings properly and will certainly consider your past behavior to get an idea of just how responsible you'll remain in the future.

In order to maintain that part of your rating high, make all your repayments on time. Can be found in second is the quantity of bank card financial debt impressive, about your credit line. That makes up 30% of your credit rating and is understood in the sector as the credit scores utilization ratio.

The reduced that ratio the much better. The size of your credit report, the type of credit score you have and next the number of new credit score applications you have actually lately submitted are the other elements that establish your Visit Your URL credit report. Beyond your credit rating score, loan providers check out your revenue, work history, liquid assets and the amount of total debt you have.

More About Personal Loans copyright

The higher your revenue and possessions and the reduced your various other financial obligation, the better you search in their eyes. Having a great credit rating when requesting an individual finance is necessary. It not only determines if you'll obtain approved yet just how much passion you'll pay over the life of the finance.

Report this wiki page